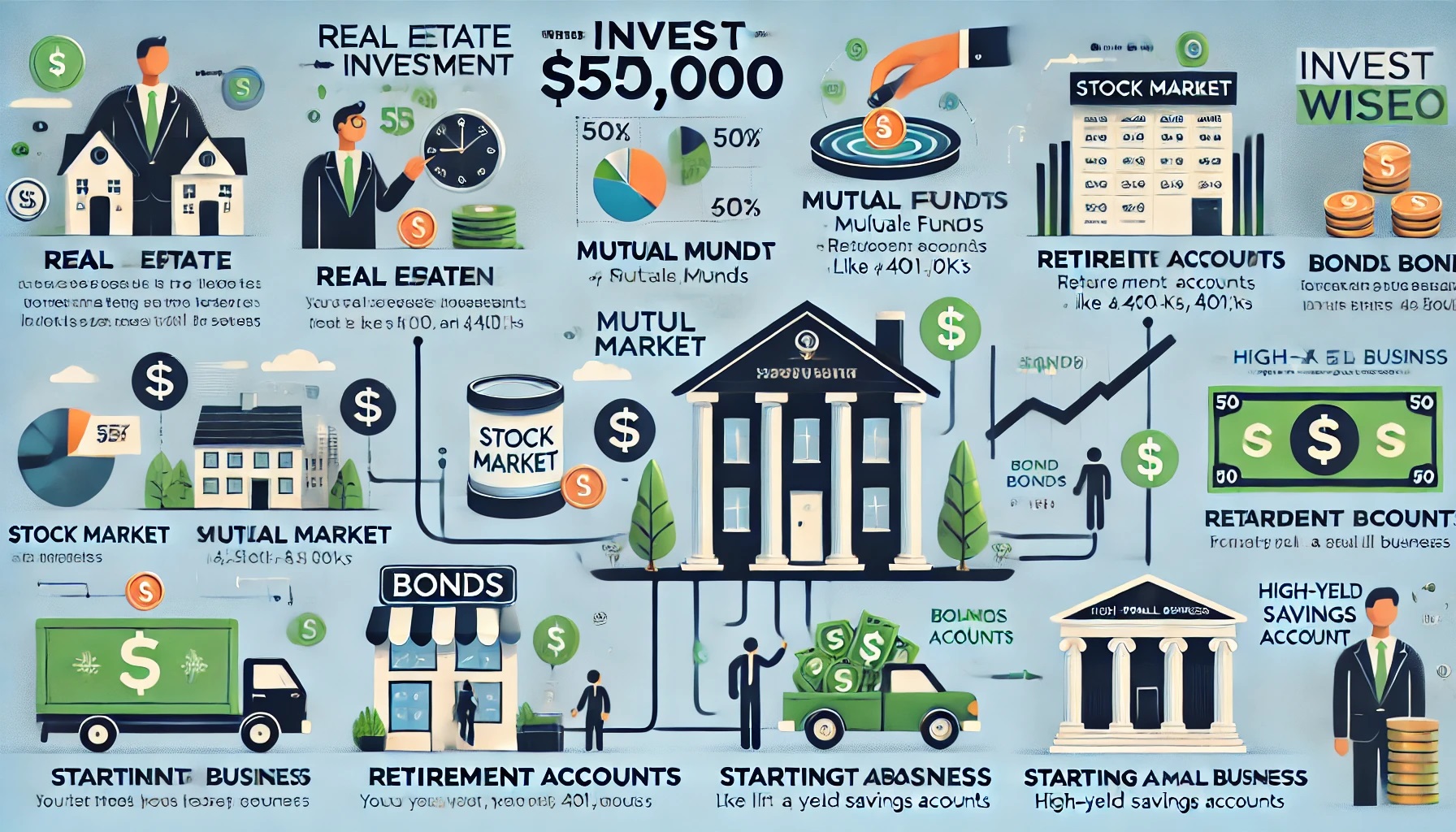

How To Invest 50k Usd Wisely Best Ways To Invest Money

How to invest $50,000 for maximum returns. Explore diverse investment options including stocks, real estate, and peer-to-peer lending.

Feb 12, 2024

Investing $50,000 wisely can set the foundation for a solid financial future. Knowing where to put your money is crucial for maximizing returns and minimizing risks. Here’s a straightforward guide to help you navigate the best ways to invest your $50,000.

1. Diversify Your Portfolio

"Diversification is the only free lunch in investing." - Harry Markowitz

- Stocks and Bonds: A balanced mix of stocks and bonds can offer both growth and stability. Stocks provide high returns, while bonds are generally safer.

- Mutual Funds and ETFs: These offer diversified exposure to various assets without the need to pick individual stocks or bonds.

- Real Estate Investment Trusts (REITs): Investing in REITs can provide exposure to real estate without the hassle of property management.

2. Consider Real Estate

Real estate can be a lucrative investment with the potential for both income and appreciation.

- Rental Properties: Buying a rental property can generate steady income through rent.

- House Flipping: This involves buying undervalued properties, renovating them, and selling them for a profit.

3. Explore Index Funds

Index funds are a great way to invest in the stock market with lower risk.

- S&P 500 Index Funds: These funds track the performance of the S&P 500, providing exposure to the largest U.S. companies.

- Total Market Index Funds: These funds offer exposure to the entire stock market, further diversifying your investment.

4. Invest In A Business

Starting or investing in a small business can yield high returns, though it comes with higher risk.

- Franchises: Investing in a franchise can be a safer way to start a business with an established brand and business model.

- Startups: While riskier, investing in startups can offer substantial returns if the business succeeds.

5. Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms allow you to lend money directly to individuals or small businesses.

- Lending Platforms: Platforms like LendingClub or Prosper let you earn interest by funding loans to individuals.

- Risks: Higher interest rates come with higher risk, so diversify your P2P loans to mitigate potential losses.

6. High-Interest Savings Accounts And CDs

If you prefer low risk, consider high-interest savings accounts or Certificates of Deposit (CDs).

- High-Interest Savings Accounts: These accounts offer higher interest rates compared to regular savings accounts.

- CDs: CDs offer fixed interest rates for a specified term, providing a guaranteed return on your investment.

7. Invest In Yourself

Investing in yourself can yield the highest returns.

- Education: Consider furthering your education or gaining new skills to increase your earning potential.

- Health: Investing in your health can improve your quality of life and productivity.

8. Cryptocurrency

Cryptocurrency is a high-risk, high-reward investment option.

Bitcoin and Altcoins: Investing in established cryptocurrencies like Bitcoin or exploring altcoins can be profitable, but it’s crucial to understand the volatility and risks involved.

Tips For Successful Investing

- Research: Always do thorough research before making any investment.

- Set Goals: Define your financial goals and risk tolerance.

- Stay Informed: Keep up with market trends and news to make informed decisions.

- Seek Professional Advice: Consider consulting with a financial advisor to create a tailored investment plan.

Conclusion

Investing $50,000 wisely requires a balanced approach and thorough research. By diversifying your investments and considering various options, you can maximize your returns and secure your financial future. Remember, the key to successful investing is to stay informed, be patient, and make well-informed decisions.

For more detailed information on investment strategies and tips, check out reliable financial news sources and consult with financial professionals.

FAQs

What Is The Safest Way To Invest $50,000?

The safest ways to invest $50,000 include high-interest savings accounts, Certificates of Deposit (CDs), and government bonds. These options provide lower returns compared to stocks or real estate but offer greater security and minimal risk of losing your principal investment.

Should I Invest All $50,000 In One Place?

No, it’s generally not advisable to invest all your money in one place. Diversifying your investments across different asset classes, such as stocks, bonds, real estate, and mutual funds, can help spread risk and increase the potential for returns. Diversification is key to a balanced and resilient investment portfolio.

How Can I Start Investing In Real Estate With $50,000?

You can start investing in real estate with $50,000 by purchasing a rental property, investing in Real Estate Investment Trusts (REITs), or participating in real estate crowdfunding platforms. Rental properties can provide steady income through rent, while REITs and crowdfunding platforms allow you to invest in real estate without directly owning property.